Table of Contents

- Invoice Layout That Reduces Payment Delays (Branding, Line Items, and Totals)

- Payment Terms That Set Clear Expectations (Due Dates, Late Fees, and Discounts)

- Payment Methods and Details That Remove Friction (Bank Transfer, Card, and References)

- Common Invoice Errors That Slow Payments (Missing Data, Disputes, and Compliance)

- Follow-Up Schedule That Gets Paid Without Damaging Relationships (Reminders, Escalation, and Templates)

- Frequently Asked Questions

- What invoice layout elements reduce payment delays and disputes?

- Which payment terms (due dates, late fees, and discounts) help clients pay faster?

- What details should you include on an invoice to prevent approval bottlenecks?

- What follow-up schedule should you use before and after the due date to speed up payment?

- How should you handle partial payments, deposits, and milestone billing on invoices?

Key takeaways

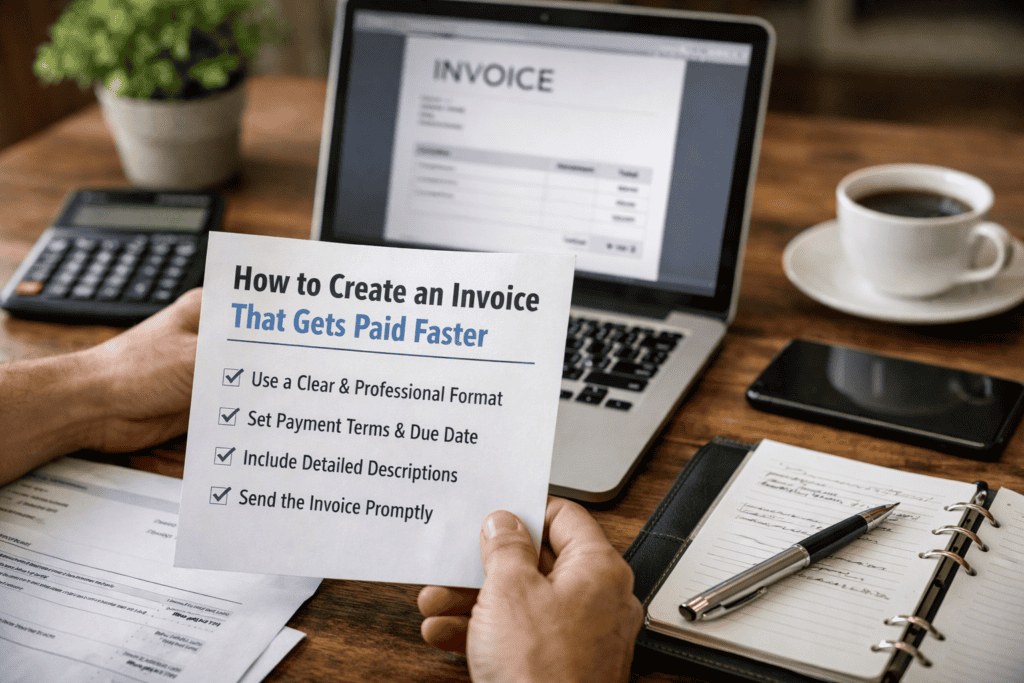

- Place invoice number, issue date, and due date at the top for quick scanning.

- Use clear line items with quantities, rates, and tax to prevent payment disputes.

- State payment terms in plain language, such as Net 7 or Net 14.

- Offer at least two payment methods and include bank details to cut delays.

- Add late fee terms and early payment discounts to shape faster payment behaviour.

- Follow a set reminder schedule: before due date, on due date, and after.

- Send invoices immediately after delivery and attach proof of work when relevant.

Invoice Layout That Reduces Payment Delays (Branding, Line Items, and Totals)

Late payment remains a measurable drag on cash flow: 52% of B2B invoices in the UK were paid late in Q4 2024, and the average payment term sat at 37 days (Atradius, Atradius). A layout that removes ambiguity can cut avoidable back-and-forth, which often adds 3–7 days when buyers need clarifications on totals, tax, or what was delivered. Place your logo and legal business name at the top, then repeat key identifiers in the header: invoice number, issue date, and due date. Buyers process invoices faster when the document matches supplier records.

Use a consistent format across every invoice, because accounts payable teams often route invoices by pattern recognition and system rules. List line items in a fixed order with clear units and rates. For example, show “10 hours × £85” rather than a single “Consulting: £850”. Separate VAT from net amounts and show the VAT rate (such as 20%) beside the VAT total. End with a single, prominent grand total, and keep it visually distinct from subtotals to prevent underpayment.

Include payment details beside the total, not on a second page. If you accept bank transfer, show sort code and account number; if you accept cards, link to a secure payment page. The UK Government reports that late payments cost small businesses around £22,000 per year on average, so small layout improvements can have outsized impact (GOV.UK).

Payment Terms That Set Clear Expectations (Due Dates, Late Fees, and Discounts)

A Kings lynn Web Design Company finishes a £2,400 website refresh on 3 February 2026. The Company emails the invoice the same day, but writes “Net 30” with no calendar date. Accounts payable files it for “end of month”, and payment slips into March.

Clear terms remove that gap. Put a specific due date such as “Due: 17 February 2026” and repeat it near the total. UK law sets statutory interest at 8% above the Bank of England base rate for late commercial payments, plus a fixed fee of £40–£100 depending on invoice size (Late Payment of Commercial Debts (Interest) Act 1998). Stating “Late fee: statutory interest + £40” sets expectations without a long policy.

If cash flow matters, offer a measured discount, for example “2% off if paid within 7 days”, and set a target using how to create smart objectives. This turns terms into a predictable payment habit.

Payment Methods and Details That Remove Friction (Bank Transfer, Card, and References)

Offering one payment route (Option A) keeps your invoice simple, but it forces the buyer to fit your process. Offering multiple routes with complete details (Option B) reduces effort for accounts payable and speeds approval. In UK B2B, 52% of invoices were paid late in Q4 2024, so small frictions can compound into real delays (Atradius).

| Element | Option A: Minimal details | Option B: Friction-free details |

|---|---|---|

| Bank transfer | Account name only | Account name, sort code, account number, IBAN, and BIC/SWIFT |

| Card payments | “Pay by card” text | Clickable link to a hosted checkout (for example, Stripe) |

| Payment references | Invoice number buried in notes | Clear “Use reference: INV-1048” near the total and bank details |

Option B works because it removes decision points. A buyer can pay by bank transfer without emailing for an IBAN, or pay by card without requesting a separate link. Put the payment reference in one fixed format and match it to your statement reconciliation, which reduces misallocated payments when a client has 10+ open invoices. If you accept card payments, state any surcharge policy clearly, since UK consumer surcharges are banned and business rules can vary (UK Government).

Common Invoice Errors That Slow Payments (Missing Data, Disputes, and Compliance)

Invoice disputes drive avoidable delays. In the UK, 52% of B2B invoices were paid late in Q4 2024 (source: Atradius). A single missing reference or tax detail can trigger an accounts payable query that adds 3–7 days to approval. Most slow payments come from three error types: missing data, mismatched delivery evidence, and compliance gaps. Fixing these issues reduces back-and-forth and helps the invoice pass “three-way matching” (invoice, purchase order, and proof of delivery) on the first attempt.

Common errors that cause payment holds

- Missing identifiers: no purchase order (PO) number, project code, or buyer contact. Many finance teams reject invoices without a PO.

- Inconsistent details: company name differs from the PO, wrong billing address, or different line-item descriptions than the quote.

- VAT mistakes: missing VAT number, wrong VAT rate, or unclear VAT breakdown. HMRC requires VAT invoices to show specific fields, including your VAT number and the VAT amount (source: GOV.UK).

- Weak evidence: no timesheet summary, delivery note, or acceptance email for milestone work.

- Compliance gaps: no registered address or company number where required. Companies House publishes official company details you can match against (source: Companies House).

Implementation steps to prevent disputes

- Create a “must-have fields” checklist: PO number, buyer legal name, billing email, due date, VAT breakdown, and bank reference.

- Match wording to the quote and PO. Keep line items identical, including units, quantities, and dates.

- Attach proof in the same email: signed delivery note, timesheet totals, or a one-page completion summary.

- Run a 60-second compliance check: VAT number format, registered address, and correct currency and tax treatment.

When invoices pass matching on the first submission, approval cycles shorten and fewer queries land in your inbox. As a result, cash arrives closer to the agreed due date, with fewer payment holds caused by preventable errors.

Follow-Up Schedule That Gets Paid Without Damaging Relationships (Reminders, Escalation, and Templates)

In 2024, 52% of UK B2B invoices were paid late, and the average term was 37 days (Atradius). A follow-up schedule turns that risk into a controlled process. It reduces “forgotten invoice” delays, while keeping the tone professional and consistent. Send the invoice within 2 hours of delivery, then schedule the first reminder 3 days before the due date. That timing catches missing purchase order details while the job still sits fresh in the buyer’s inbox.

On the due date, send a short note that repeats the invoice number, amount, and payment link, and ask for a confirmed pay date. If payment has not arrived, escalate in measured steps: 3 days overdue, 7 days overdue, and 14 days overdue. At 3 days, ask whether accounts payable needs any documents. At 7 days, request a firm payment date and name the late fee or statutory interest that applies. At 14 days, switch from email to a phone call and confirm the next action, such as pausing work or issuing a formal letter.

Keep each message under 90 words and include one clear ask. This discipline mirrors how how do entrepreneurs spot patterns early: track response times, note bottlenecks, and refine the schedule when approvals repeatedly stall at the same step.

Frequently Asked Questions

What invoice layout elements reduce payment delays and disputes?

Use a clear header with invoice number, issue date, due date, and purchase order. List supplier and customer details, then itemise work with quantities, rates, tax, and totals. Show the amount due in one place, plus payment methods and bank details. Add short terms, late fees, and a contact for queries.

Which payment terms (due dates, late fees, and discounts) help clients pay faster?

Use short, clear terms: “Due in 7–14 days” with a fixed date. Offer a small early-pay discount, such as 1–2% if paid within 7 days. Add a late fee that starts after a grace period, such as 1.5% per month (or £40+ under the Late Payment of Commercial Debts rules). State accepted payment methods.

What details should you include on an invoice to prevent approval bottlenecks?

Include a unique invoice number, issue date, supplier name and address, client billing contact, purchase order or contract reference, clear line items (quantity, rate, tax), totals and currency, payment terms (due date, late fees), payment method details, and supporting notes (project code, delivery date). Add the approver name and required cost centre to speed sign-off.

What follow-up schedule should you use before and after the due date to speed up payment?

Send a reminder 7 days before the due date, then 3 days before. On the due date, send a short “due today” note. After the due date, follow up at 1 day overdue, 7 days overdue, and 14 days overdue. At 21 days overdue, call and confirm the payment date in writing.

How should you handle partial payments, deposits, and milestone billing on invoices?

Show deposits, milestones, and part-payments as separate line items with dates, amounts, and what each covers. State the total contract value, amount billed now, amount received, and the balance due. Set clear due dates for each stage, and add a short note on when work starts or continues after each payment clears.